In October 2024, Rachel Reeves, in her first budget as Chancellor, made several announcements around alcohol taxes. Here are a few thoughts on what those might mean.

There were three important changes to alcohol duty rates, all of which will come into effect from February 2025:

- A small increase, in line with inflation, in duty rates.

- Confirmation that the 'wine easement', under which all wine between 11.5% and 14.5% ABV was taxed as if it were 12.5%, will be removed as planned.

- A cut in 'draught relief' duty rates that apply to products sold on draught in pubs.

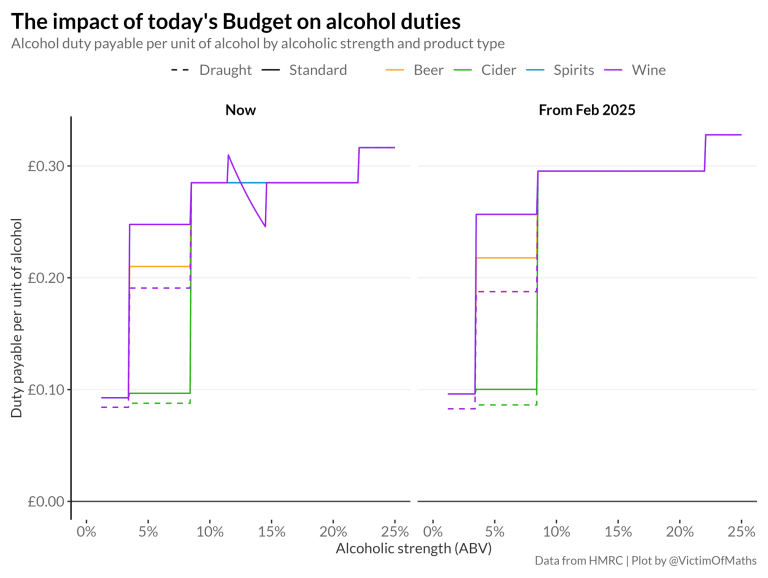

Here's what these changes look like visually when we plot duty rates per unit of alcohol against ABV:

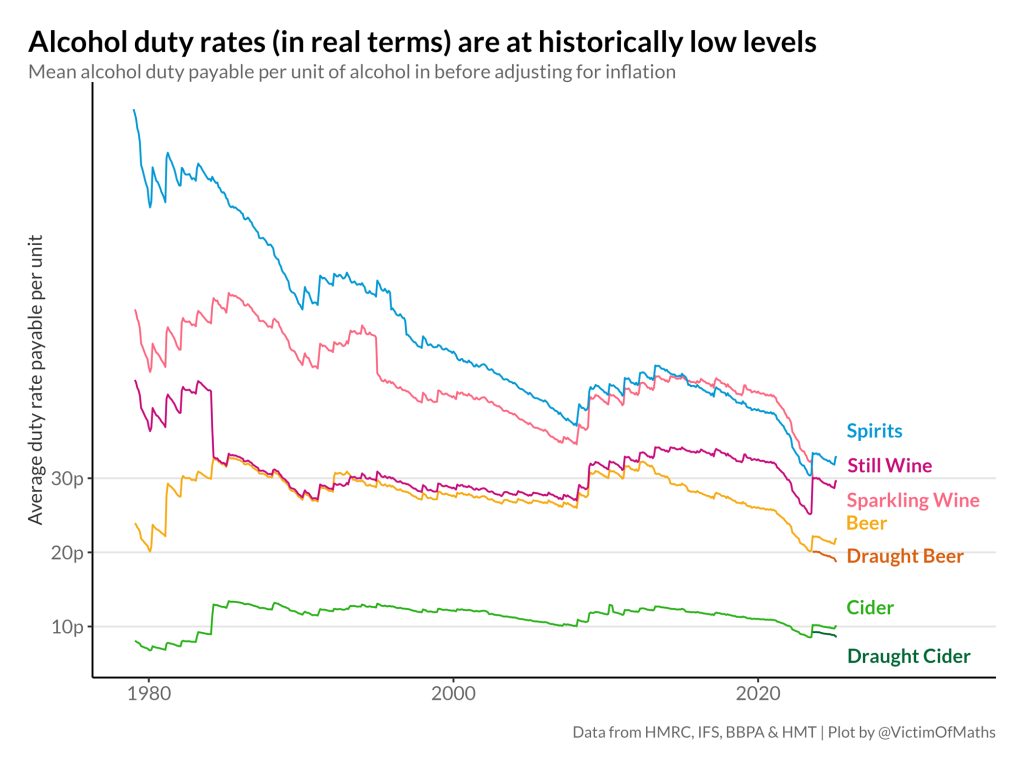

The first thing to recognise is that raising duties in line with inflation is not an increase as some will portray it. It's just keeping alcohol taxes at the same level after adjusting for inflation. So we wouldn't expect this announcement to do anything to reduce alcohol harms. Which are at record levels. But at least it's not going to make alcohol in shops (which accounts for the overwhelming majority of alcohol sales) cheaper.

We've seen multiple Chancellors over the past decade cut or freeze alcohol duties. In 2019 we estimated that duty cuts and freezes since 2012 had led to over 2,000 additional deaths linked to alcohol in England and Scotland.

Secondly, the increase in the 'draught relief' is interesting. It's not totally clear from a narrow public health focus if encouraging people to shift drinking from homes back to pubs (a reversal of a decades-long trend) would be a good thing, but I don't think many people would take issue with the government trying to take action to help the hospitality sector. And this seems like a pretty sensible, if small, way to do that.

It's also notable that although the Chancellor announced the draught relief cut as "A penny off a pint in the pub", that is the cash-terms cut. Once you account for the inflation-linked increase in non-draught products, the difference in duty payable on an average pint of beer between a pub and a supermarket will rise from 4p to 7p in February.

Finally, removing the 'wine easement' is a positive step. The purpose of the revisions made to the UK alcohol duty system in August 2023 were to ensure that all products were taxed on the basis of their alcohol content. This offers a financial incentive for both producers and consumers towards lower-strength products – something we've clearly seen with the rise in lower ABV beers. The easement was a wrinkle in this approach and it's good to see it being ironed out.

Overall, this budget is certainly an improvement on the last budget when the Government froze all alcohol duties 'to support pubs', even though it does the opposite. So it's at least logically coherent to see a Chancellor using the mechanism specifically designed to help pubs to try to help pubs.

I'd sum it up as better than it could have been, but it's very much a 'keep the status quo' budget for alcohol, not a 'let's do something to reduce harms' one.

Alcohol duty rates across all products remain at historically low levels and as a result alcoholic products are more affordable than at any point in the past 40 years. Addressing that affordability will be key if the Government are serious about reducing alcohol harms.