This is a guest post by Dr Nathan Critchlow, Research Fellow at the Institute for Social Marketing and Health, University of Stirling.

Alcohol-free and low-alcohol (no/lo) drinks are defined, in Great Britain, as beers, ciders, spirits and wines containing no more than 1.2% alcohol by volume (ABV). These drinks are becoming increasingly popular, with around a third of adults saying they have consumed no/lo drinks before and around a third saying they do on a weekly basis.

Currently, however, there is still a lot that we don't know about the no/lo market. When did it start to appear? Has the market finished developing or is there more to come? What role have industry, retailers, or the government played in developing the market?

We sought to answer some of these questions through our NIHR-funded project investigating whether alcohol-free and low-alcohol drinks are improving people's health. The findings appear in our paper exploring the development of the no/lo drinks market in Great Britain between 2011 and 2022, which was published recently in Drug and Alcohol Review. This blog post aims to give an overview of the study and what it revealed.

Data collection and analysis

We examined a variety of sources, including five market intelligence reports and over 1,300 articles in specialist magazines aimed at shops which sell alcohol. Members of the project team based at the University of Stirling read each one line-by-line to identify information on:

- product launches and rebrands

- marketing campaigns

- industry changes (e.g. mergers and acquisitions)

- retailer actions (e.g. changes in what products are stocked)

- government actions (e.g. policy changes)

- activities by third-sector organisations (e.g. abstinence campaigns)

Our findings were recorded as 'events' in a comprehensive database which we then used to build a series of timelines showing the development of the no/lo market in Great Britain.

Overview of results

Here's a summary of the key events we identified, broken down by categories (e.g. beers, ciders, wines etc) and key 'cross-cutting' events likely to have influenced the overall no/lo market.

Cross-cutting events

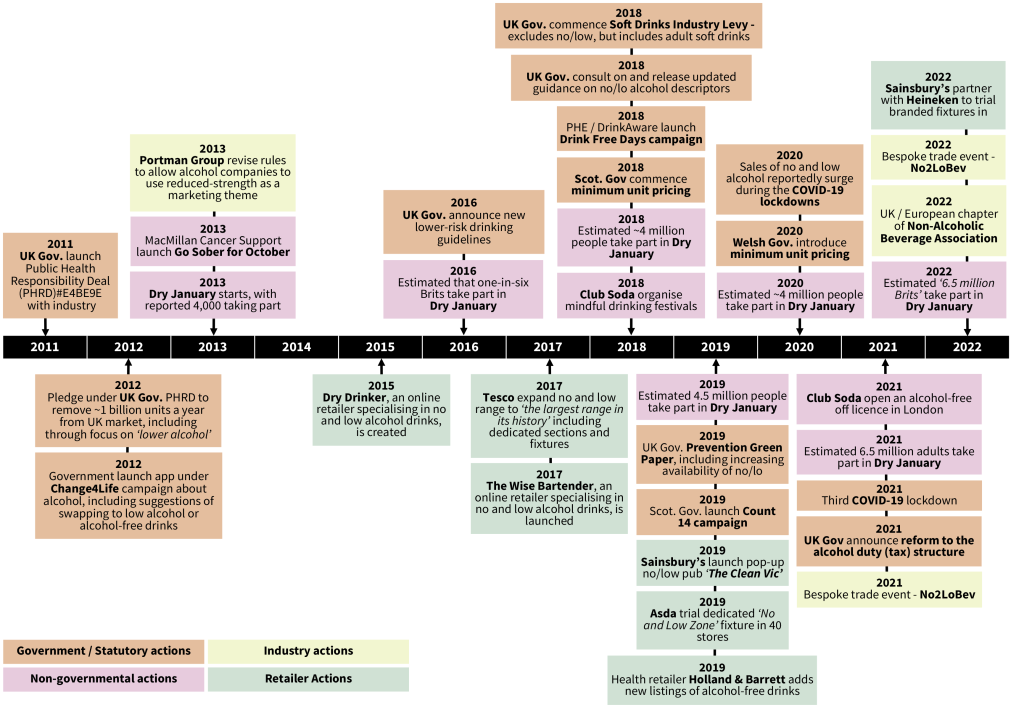

These were activities by the government, retailers, producers, and third sector organisations (e.g. charities) likely to have directly or indirectly affected the overall no/lo drinks market. As shown by the diagram below, we saw more of these events in the second half of the timeline, as the no/lo market emerged and established.

Timeline of cross-cutting events which may have directly or indirectly impacted the overall no/lo market between 2011 and 2022 – click to view full size.

Direct activity from the Government included a 2018 consultation about how companies can describe no/lo drinks, for example on labels, which led to revised guidance being published later that year. The Government also committed in 2019 to work with the industry to expand the availability of no/lo drinks. Examples of indirect activity from the Government included launching revised low-risk drinking guidelines in 2016 and reforming the alcohol tax system in 2023. Although neither were directly focused on no/lo drinks, they may have had indirect impacts on the market.

Retailers significantly expanded their no/lo offerings, particularly in the later years of the timeline, with Tesco leading this trend from 2017. This involved increasing the range of products stocked and, in some cases, trialing dedicated no/lo sections within stores. Online retailers specialising in no/lo drinks also emerged.

The growing importance of the no/lo market was also highlighted by activity among producers and distributors to organise and promote the market, such as establishing new industry trade shows and trade associations that were dedicated to no/lo drinks.

Finally, third-sector organisations and public health activities, such as Dry January ® , have also likely played a role in the growing prominence of the market. Namely, increased participation in temporary abstinence campaigns has provided producers with opportunities to launch and promote no/lo products, with marketing activities often concentrating around January.

Beer

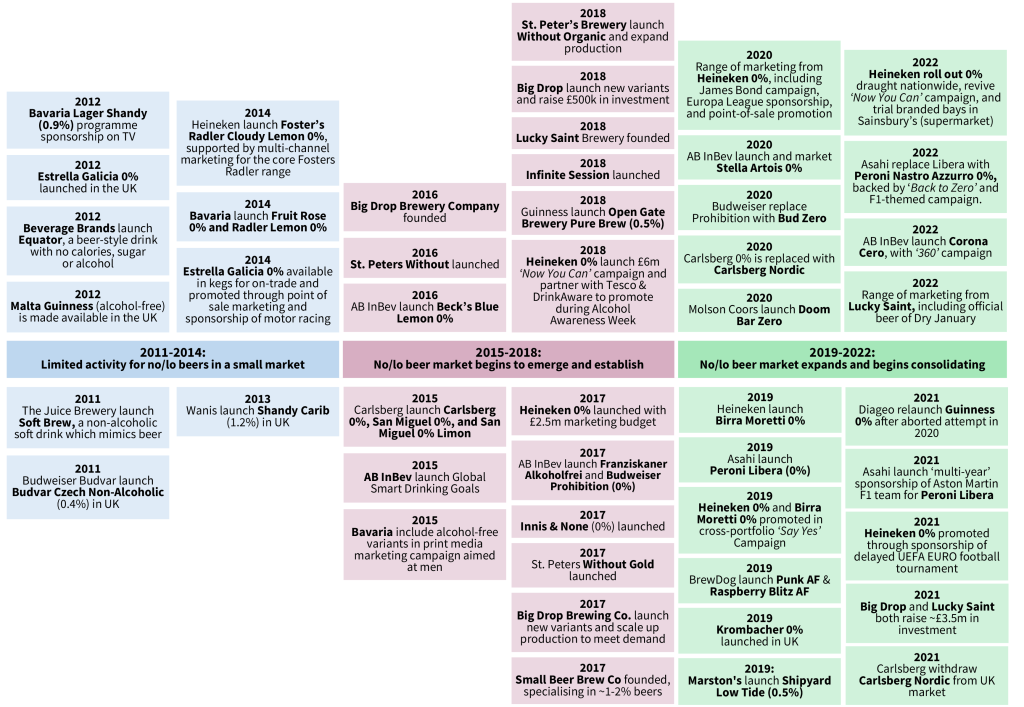

Timeline of key phases and example events in the development of the no/lo beer market between 2011 and 2022 – click to view full size.

The no/lo beer sector dominates the overall no/lo market in Great Britain and our research found that its development occurred in three phases.

- Initially (2011-2014), activity centered on lower-strength beers (2-3% ABV) from mainstream brands, rather than products below 1.2% ABV. This interest was influenced by a partnership between the UK Government and industry at the time, known as the Public Health Responsibility Deal, which included a commitment to increase the availability and consumption of lower-strength alcoholic drinks.

- The second phase (2015-2018) saw the emergence of true alcohol-free or low-alcohol beers, with major brands like Heineken entering the market, and the growth of independent no/lo breweries. The launch of Heineken 0.0% was a key event and it quickly became the best-selling alcohol-free beer.

- In the last phase (2019-2022), more companies like Asahi and Diageo started selling no/lo beers under their existing brands, such as Peroni and Guinness. Meanwhile others like Heineken and AB InBev focused on growing their existing no/lo business. Independent breweries, such as Lucky Saint and Big Drop Brewing Co, also continued to expand.

Cider

Cider is the second-largest no/lo sector in Great Britain.

- Initial activity (2011-2016) was limited. Kopparberg had previously launched an alcohol-free pear cider in 2010 and followed this up with a new flavour variant during this period.

- The no/lo cider market developed more in the second phase (2017-2019), with launches from key brands like Weston's, Old Mout (Heineken) and Sheppy's.

- The final phase (2020-2022) saw further expansion, with more launches and marketing from established producers. Fruit-flavoured, alcohol-free ciders were particularly popular in this period, mirroring trends in the standard-strength cider market.

View the timeline in the published paper.

Wine

Wine is currently the third-largest no/lo category in Great Britain.

- Initially (2011-2015), the focus was on lower-strength wines (around 5.5% ABV), similar to the interest in lower-strength beers observed in the same period. Mainstream producers like Accolade Wines and E&J Gallo launched products around this strength, while activity for no/lo wines was mainly focused around the Eisberg brand.

- In the second phase (2016-2019), the no/lo wine market expanded and saw launches from mainstream producers. For example, Reh Kendermann launched B Zero in 2016, which was reportedly the first alcohol-free wine under the mainstream Black Tower brand.

- The final phase (2020-2022) saw wine producers consolidate and expand. For example, Accolade Wine relaunched Hardy's Zero, including new flavour varieties, and launched a new brand of alcohol-free wines, called &Then. They highlighted that these new products were driven by 'revolutionary' and 'cutting edge' advancements in de-alcoholisation technology.

Despite these recent advances, and some successful launches of sparkling no/lo wines, the no/lo wine market still has a much smaller share of the no/lo drinks market than standard wine does of the overall alcoholic drinks market.

View the timeline in the published paper.

Spirits

The no/lo spirits market emerged later than other categories but has grown significantly and now accounts for market share broadly comparable to no/lo ciders and wines.

- In the initial phase (2015-2017), Seedlip's launch of a distilled non-alcoholic spirit in 2015 was the only notable event.

- The second phase (2018-2019) saw rapid expansion with numerous new brands appearing. Seedlip also used marketing to reinforce its position in the market and major producer Diageo bought a 'majority stake' in the company.

- The final phase (2020-2022) was characterised by further growth and consolidation, including mainstream producers like Diageo launching alcohol-free versions of established gins (Gordon's, Tanqueray). Existing brands like CleanCo also expanded and invested heavily in marketing.

View the timeline in the published paper.

Ready-to-drink (RTD)

The no/lo RTD market is small, representing only 1% of no/lo sales.

- Initially (2011-2016), activity was limited to soft drink brands offering non-alcoholic versions of cocktails.

- The market began to emerge in the second phase (2017-2019), with Diageo launching a low-alcohol canned gin and tonic, and the appearance of several independent companies specialising in no/lo RTDs, such as Punchy Drinks.

- Further expansion occurred in the final phase (2020-2022), with brands already in the no/lo spirits market, such as CleanCo and Lyre's, introducing RTD products.

View the timeline in the published paper.

Adult soft drinks

Adult soft drinks are closely linked to the no/lo market and activity was seen from both larger soft drinks producers and independent companies across the timeframe.

Most of the activity was soft drinks companies making products themed around popular cocktail flavours or soft drinks marketed as 'alternatives' to wine. There was little evidence of alcohol companies attempting to move into the soft drink market, with BrewDog's POP Soda (2022) the notable exception.

The UK's Soft Drinks Industry Levy, implemented in 2018, taxes added sugar and therefore significantly affects the adult soft drink market. Notably, the levy exempts de-alcoholised 'alcohol replacement drinks' (like no/lo beer and wine), therefore giving no/lo drinks a potential market advantage over standard adult soft drinks.

Summary of findings

Our findings show that the no/lo drinks market in Great Britain has undergone considerable development in the past decade. Alcohol producers experimented with a variety of products before settling on their current approach of selling no/lo versions of their existing brands. This development, characterised by product launches, increased marketing, and expansion across drink categories, has been largely shaped by commercial forces, with additional influence from initiatives like Dry January ®. It is important to note, however, that the market is still evolving, and its future development and potential impacts are yet to be fully understood.

Given the potential public health consequences – including the risk of no/lo drinks supplementing rather than replacing standard alcohol and the possible normalisation of alcohol consumption – continued monitoring of this market is essential. Through our NIHR-funded No/Lo Project, we are undertaking this crucial work, examining consumer behaviour, marketing impacts and health inequalities to provide a robust evidence base for public health strategies.