The Autumn Budget 2025 delivered several key announcements with direct implications for alcohol policy, tobacco and vape taxation, and gambling regulation in the UK.

In this post, SARG experts Professor Colin Angus, Dr Duncan Gillespie and Dr Ellen McGrane, analyse the key policy decisions. They explore the effects of maintaining inflation-linked alcohol duties and licensing policy changes, new tax policies and duty stamp scheme for tobacco and vaping products, and the reforms aligning gambling taxes with risk.

For our full economic and public health modelling of potential alternative policies for alcohol and tobacco, read our accompanying Budget Briefing Note.

Jump to: Alcohol | Tobacco and Vaping | Gambling

Alcohol policy changes

Professor Colin Angus

Alcohol taxes

The Autumn Budget 2025 was a relatively quiet one for alcohol policy. The main announcement from the Chancellor was the decision to increase alcohol duty rates in line with RPI inflation. This means that from February 2026 alcohol duty rates will rise by 3.66%, an increase of around 2p on a pint of beer, or 10p on a bottle of wine.

It is important to recognise that inflation-linked increases like this simply maintain the real-terms level of alcohol taxes – ensuring that inflation doesn't erode the effective value of duty rates. As a result, we wouldn't expect any significant impact of this announcement on alcohol consumption, or alcohol-related health outcomes, as it is just maintaining the affordability of alcohol at the same level, accounting for inflation.

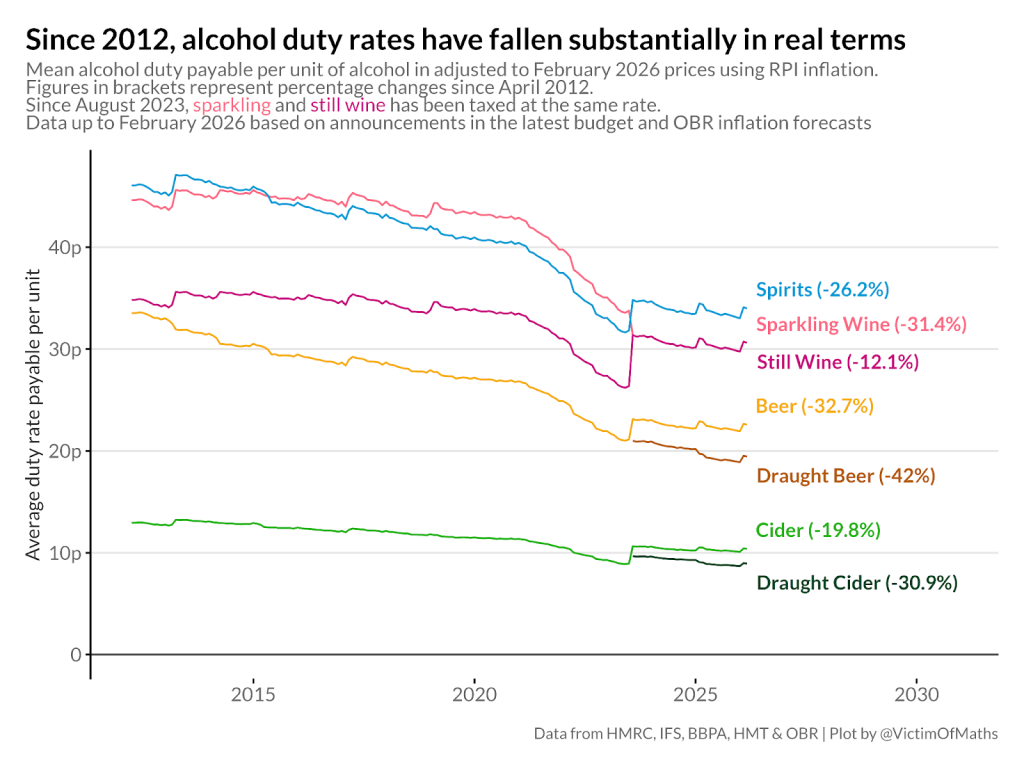

This is the second successive budget in which alcohol taxes have seen an inflation-linked increase, marking a departure from the previous government, who consistently froze or cut alcohol duty rates between 2013 and 2024. From the perspective of public health, this is a positive step as it prevents alcohol becoming more affordable, but it does not address the fact that the legacy of these cuts and freezes are alcohol duty rates that are well below their 2012 levels.

One interesting feature of the budget is hidden in the details of the Office for Budget Responsibility's (OBR) updated economic forecasts, which estimates that the overall amount of money that the Treasury receives in alcohol taxes is expected to be £12 billion in 2025-26, a 5.1% fall from the previous year. This is in line with our own analyses that have pointed to falling alcohol duty revenue since 2022.

The OBR point to "a growing trend of alcohol moderation, with substitution to no- and low-alcohol alternatives" alongside higher prices and falling alcohol consumption among younger age groups as possible explanations for this fall. While it is certainly the case that the no- and low-alcohol market has expanded in recent years, there is little robust evidence to date that shows that this expansion is driving increased moderation, rather than being a response to it, so we should perhaps be a little cautious about attributing falling alcohol sales to the rise of no- and low-alcohol products.

Alcohol licensing

There has been little public or media attention paid to it, but the Autumn Budget also included some new developments in alcohol licensing policy.

This summer, the government warmly welcomed proposals to significantly overhaul the way that the sale of alcohol is licensed in England and Wales. These proposals, which were developed without any input from the Department of Health and Social Care or wider public health stakeholders, were roundly criticised by academics and public health groups as being a significant liberalisation of the licensing system that removes one of the few powers that local authorities have to tackle alcohol-related harms in their area.

The government launched a call for evidence around the proposals in October, with analysis of the responses published alongside the budget. These showed significant polarisation, with the hospitality industry largely in support of the proposed reforms and the public health sector largely in opposition.

Amongst this controversy, the Department for Business and Trade published a new National Licensing Policy Framework, which sets out the government's strategic vision for the licensing system and acts as guidance for local authorities and their approach to alcohol licensing.

The new framework does not include some of the more controversial aspects of the proposed reforms, most notably an explicit requirement that economic growth be included as a stated goal of the licensing system, and its scope is restricted to the on-trade (places like pubs, bars and restaurants where alcohol is sold for consumption on the premises). However, it is likely that it will place additional pressure on local authorities to take a more permissive, industry-friendly, approach to alcohol licensing, which is likely to have negative implications for public health.

Tobacco and vaping taxes

Dr Duncan Gillespie

The Autumn Budget 2025 announced important changes to taxes on tobacco and is adding a new tax on vaping liquids.

Changes to hand-rolling tobacco tax policy

In the Autumn Statement 2023 and the Autumn Budget 2024, the government made hand-rolling tobacco less affordable relative to regular factory-made cigarettes by increasing tax on hand-rolling tobacco by an additional 10% more than factory-made cigarettes. The reason for doing so was motivated by public health: hand-rolling tobacco is the more affordable option, making it potentially important for price-sensitive young people starting smoking or for people who currently smoke to switch to a more affordable option – rather than stop smoking altogether – when tobacco taxes go up. The higher tax rise on hand-rolling tobacco acted to narrow this affordability gap.

The 2025 Budget changes this approach. The tax on both factory-made cigarettes and hand-rolling tobacco went up by the same amount: Retail Price Index (an inflation measure) plus 2%. This meant both categories saw an immediate tax rise of 5.66% (given the current rate of inflation), going against the recent trend of much higher tax increases on hand-rolling tobacco than factory-made cigarettes.

A new Vaping Products Duty

A major new step is the introduction of a new tax, the Vaping Products Duty (VPD), on the e-liquid used in vapes, set at £2.20 per 10mL. This is due to start on 1 October 2026. The duty will apply to all vaping liquid, covering both nicotine and zero-nicotine liquids, because it targets any liquid specifically intended to be vapourised in a vape device. Currently the only tax on vapes is the standard 20% VAT. The main goal of this new tax is to make vaping less affordable for young people who have never smoked, discouraging them from starting to vape.

The tables below give some examples of how the Vaping Products Duty will affect prices:

|

Component |

Current price: vape pod with 2mL e-liquid |

Price with VPD: vape pod with 2mL e-liquid |

|---|---|---|

|

Retail price (including VAT) |

£3.00 |

£3.00 |

|

New Vaping Products Duty |

£0.00 |

£0.44 |

|

Additional VAT (20% on the VPD) |

£0.00 |

£0.09 |

|

Total price to consumer |

£3.00 |

£3.53 |

|

Component |

Current price: budget |

Price with VPD: budget |

|---|---|---|

|

Retail price (including VAT) |

£1.00 | |

|

New Vaping Products Duty |

£0.00 |

£2.20 |

|

Additional VAT (20% on the VPD) |

£0.00 |

£0.44 |

|

Total price to consumer |

£1.00 |

£3.64 |

Introducing the Vaping Duty Stamps scheme

What is less widely known is that the government will also introduce a new Vaping Duty Stamps scheme at the same time. This should help enforcement officers (like HMRC and Trading Standards) to quickly differentiate legal, taxed products from illegal, untaxed, or counterfeit stock. These illegal or non-compliant vapes have become a big problem recently – their ingredients are uncertain and they can contain very high doses of nicotine – but they can be indistinguishable on shop shelves from legal vapes that are compliant with regulations. So this change is significant in giving enforcement agencies more powers and making it easier for them to intercept illicit vapes.

Timing the tobacco and vape tax changes

An additional tax rise on tobacco was also announced – to coincide with the new Vaping Products Duty on 1 October 2026. This is a one-time increase for tobacco tax of £2.20 per 100 factory-made cigarettes or 50g of hand-rolling tobacco. We've calculated that when this later tax is added, it will raise the post-budget tax on hand-rolling tobacco by a slightly bigger percentage (8.7%) than on factory-made cigarettes (6.2%).

By timing the additional tobacco tax rise to happen at the same time as the new Vaping Products Duty, the government wants to make sure that when the new vape tax is introduced, tobacco does not become any more affordable relative to vaping. The idea of doing so is to discourage people who currently vape from going back to smoking tobacco because of the new vape tax.

Future implications for vape taxation policy

Now that the new vape duty has been announced, it is likely that it will be reviewed every year and should be expected to increase alongside tobacco tax. This means that there will be a lot of interest in whether this new vape tax is having its intended public health effects, and whether it needs to be restructured in some way or set at a different level.

Gambling taxes

Dr Ellen McGrane

In the Autumn Budget 2025, the Chancellor announced a significant reform of gambling taxes, with a particular focus on remote gambling. This primarily affects any gambling conducted online, over the telephone, television, radio, or other technologies like betting apps and machines in shops.

The changes aim to simplify the tax system and raise revenue to support public finances. Importantly, they are designed to reduce exposure to higher-risk gambling products by aligning tax rates with levels of associated harm. Targeting higher rates towards these products reflects the clearly documented risks they pose.

Aligning tax rates with gambling harm

The government has specifically targeted higher rates towards products associated with greater harm. Recent data indicate that individuals who report engaging in online slots or casino games in the past year are around five times more likely to fall into the highest-risk category, as measured by the Problem Gambling Severity Index (PGSI). This evidence underpins the new duty reforms, which include:

|

Gambling Product Category |

Old Tax Rate |

New Tax Rate |

Harm Association (Risk) |

|---|---|---|---|

|

Remote Gaming (e.g. online slots / casino / bingo) |

21% |

40% |

Highest risk |

|

Remote Betting (e.g. online sports betting) |

15% |

25% |

Lower risk than gaming |

|

Bingo (in-person) |

10% |

Repealed |

Lowest risk |

As highlighted in the table, the separate bingo duty for land-based halls has been repealed, as these are considered lower risk. In contrast, remote bingo will be subject to the highest 40% rate due to its greater potential for harm.

Exclusions: It is important to note that Horseracing Duty remains at 15% in line with land-based betting, due to operators' contributions to the statutory Horseracing Betting Levy, which funds the improvement of racing and horse breeds as well as veterinary research.

Outstanding policy concerns

While these measures signal a policy shift toward harm reduction and recognition of the risks posed by certain products, some concerns remain. Researchers note that certain high-risk products, such as Electronic Gaming Machines (EGMs) in adult gaming centres, are still outside the scope of the reforms despite their known association with harm.

The government has acknowledged that the new duties may negatively affect odds and consumer returns. Together, however, these measures represent a significant step in using fiscal policy to address public health concerns related to gambling.

More Budget analysis from the Sheffield Addictions Research Group

Budget Briefing Notes – our rapid-response reports use the sophisticated Sheffield Tobacco and Alcohol Modelling Platform (STAPM) to estimate the potential health and economic effects of changes to tobacco and alcohol tax announced in UK Government Budgets.

The impact of the October 2024 Budget announcement on alcohol duties – Colin Angus shares his thoughts on the October 2024 Budget announcement and how it will impact on alcohol duties.

Spring Budget 2024: What does it mean for alcohol and e-cigarettes? – Following the Spring Budget on 6 March 2024, SARG experts Colin Angus and Duncan Gillespie take a look at what it means for alcohol and e-cigarette taxes.